Craft Brewers Conference Series (1/5) – Consumer Behavior Trends

As a follow-up to our Untappd Insights: Consumer, Beer, Brewery, and On-Premise Pricing Trends presentation at the Craft Brewers Conference in Nashville on May 8th, I’m circulating five newsletter updates over the next two weeks, each covering a different section of the data I presented at the show!

We also provided complimentary Brewery Consumer Reports to brewers who demoed our Ollie brewery management software platform at the show (as well as to current Ollie customers). We’ll extend that offer to this readership – head here to schedule your Ollie demo and we’ll provide you with a free Brewery Consumer Report on your brewery.

Now, let’s explore some consumer behavior trends from the CBC presentation.

The Consumer Return to the On-Premise Post-COVID has Leveled Off

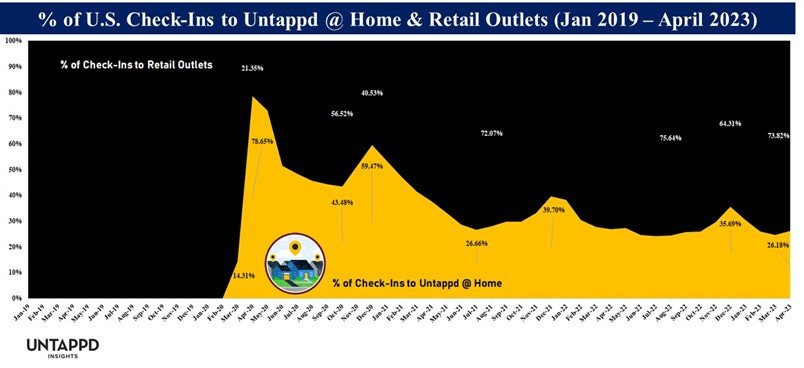

The graph above shows the percentage share of check-ins to our Untappd @ Home venue (i.e., users indicating they are checking-in the beer they’re consuming at their home) over the total # of check-ins to Untappd @ Home + all check-ins to retail outlets. As you can see, nearly 80% of check-ins from our users came at home during the COVID lockdown period of March/April 2020. By April 2021, just under 38% of check-ins with a consumption venue specified were logged at users’ homes. April 2022 saw close to an 11% decrease relative to April 2021 – down to 26.84% – of check-ins happening at home. While the percentage of consumption moments logged at home continues to decrease slightly in 2023 relative to 2022, the trend does seem to have stabilized in this post-COVID world (26.18% of check-ins with a venue denoted were to Untappd @ Home in April 2023). In examining the 2023 vs. 2022 trends in our data, it does appear that the split between at-home consumption and on-premise consumption has largely stabilized.

Consumers at Brewery Taprooms are Getting Older… and Younger

Yes, you read that right. There’s been a barbell effect to the demographic makeup of taproom visitors. A brewery owner friend of mine commented to me last year that he was seeing fewer families in his taproom. We investigated the data then and the age share shift his taproom was experiencing held true in our data nationwide. An increasing share of check-ins at brewery taprooms are coming from the 21 – 25 age bracket and the 50+ age group, while the 31 – 35 and 36 – 40 age ranges are losing relative share. I suspect the initial driver of this trend in 2020 – 2021 was families not wanting to take unvaccinated children into public spaces. It surprised me that the trend has continued in 2022 and 2023. I suspect inflationary pressures for young families, more acute perhaps relative to the carefree 21 – 25-year-old set and those nearing or at retirement with kids out of the house, is a contributing factor.

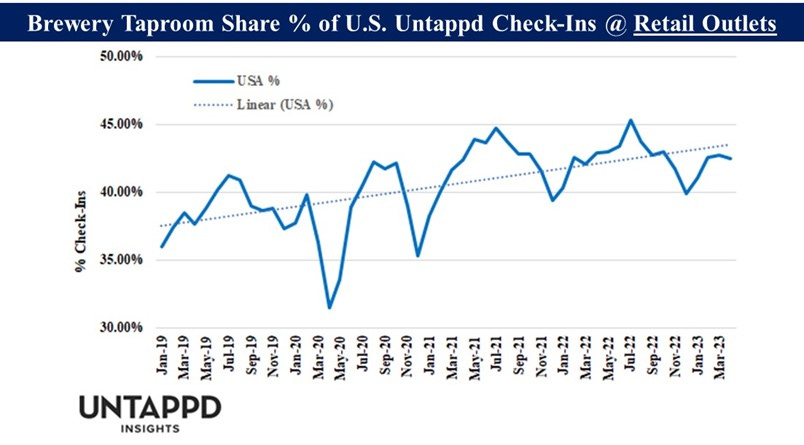

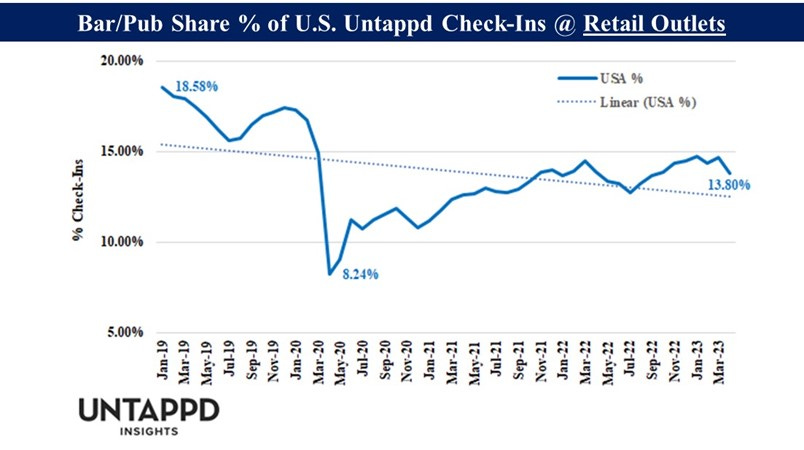

Brewery Taprooms are Taking Share from Bars & Pubs

As can be seen from the top graph above, in 2019, 36% - 42% of check-ins to retail outlets happened at brewery taprooms. Fast forward to 2022/2023 and the range has increased to 40% to 45%. Meanwhile, as illustrated by the bottom of the two graphs directly above, check-in share among Bars & Pubs vs. all retail outlets shrunk from the 16% - 19% range in 2019 down to the just north of 8% during COVID (and has leveled off at ~13% today). Among our userbase, which is representative of on-premise craft consumers, taprooms have clearly taken share from traditional bars and pubs. There are two primary causes in our view: 1) there continue to be more taproom openings than closings, meaning the share of taprooms as a percentage of all retail outlets continues to grow and 2) taprooms generally offer more outdoor seating and more spacious environments than traditional bars and pubs. While most consumers have put COVID in the rearview mirror and, I suspect, no longer factor in the actual physical space/outdoor seating options when considering where to drink, the share gains among brewery taprooms during COVID, when such health and safety considerations were front of mind, seem to have stuck.

The next Untappd Insights newsletter update, scheduled for later this week, will cover trends in beer styles.

Until then, check-in your beers!