Beer Style Trends - Craft Brewers Conference Series (2/5)

This is the second of five newsletter updates we’re circulating as a follow-up to my May 8th Untappd Insights: Consumer, Beer, Brewery, and On-Premise Pricing Trends presentation at the Craft Brewers Conference in Nashville.

As a reminder, we also provided complimentary Brewery Consumer Reports to brewers who demoed our Ollie brewery management software platform at CBC (as well as to current Ollie customers). We’ll extend that offer to this readership – you can schedule a demo of Ollie here and we’ll provide you with a free Brewery Consumer Report on your brewery.

Now, let’s examine recent trends in beer styles.

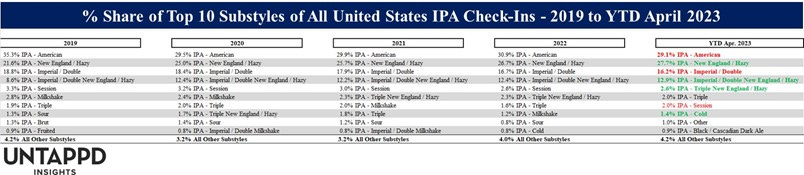

A few observations on trends among our ten most popular substyles on Untappd year-to-date through April 2023:

IPAs remain king – the top four most checked-in substyles are all IPAs, accounting for nearly 34% of all check-ins on Untappd.

Since 2019, American IPAs and Double IPAs have lost share, which seems to have been absorbed primarily by New England / Hazy IPAs and Double New England / Hazy IPAs.

While the year-to-date April nature of the 2023 data likely skews a bit to styles popular in cold weather months (vs. a full year of data), Stouts are up in 2023 thus far over prior years.

American Lagers were not among the 10 most popular substyles for our users in 2020 or 2021, but have climbed to eighth position in 2022 and have remained in that spot through YTD April 2023.

And how about trends within the parent IPA style?

The same trends with respect to loss of share from American and Double IPAs and gain of share from all types (regular, double, and triple) of New England / Hazy IPAs hold true within the IPA style.

Session IPAs have lost share, accounting for 3.3% of all IPA check-ins in 2019 vs. 2.0% YTD April 2023.

Cold IPAs have climbed to the 8th most popular IPA substyle after not even cracking the top 10 in 2019, 2020, or 2021.

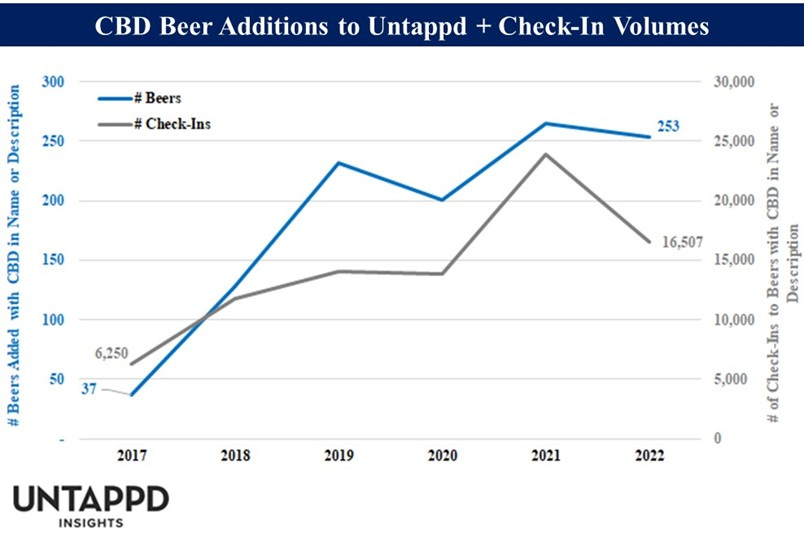

CBD Beers Have Reached Their High

While a lot of ink is spilled about CBD beers, our data suggests the fad peaked in 2021 and is losing momentum. There were fewer beers added to Untappd by brewers with CBD either in the beer name or description in 2022 vs. 2021. Additionally, check-ins to beers with CBD in the name or description were down from nearly 25,000 in 2021 to 16,507 in 2022. Our data suggests CBD beers are a dying fad that never really had mainstream appeal (15k – 25k U.S. check-ins out of nearly 55 million on an annual basis hardly constitutes a drop in the proverbial bucket).

The third of five CBC Untappd Insights newsletter updates, scheduled for early next week, will reveal the 25 fastest growing breweries in the U.S.

Until then, check-in your beers!