Draft Beer Prices - Inflation Tamed in 2H 2023

Q4 2023 Untappd Insights Draft Beer Pricing Index Release Reveals Inflation Moderation in Second Half of 2023

On-premise draft pricing data aggregated from nearly 20,000 Untappd for Business Verified Venues indicates that inflation in beer prices moderated in the back-half of 2023 alongside other goods and services.

As outlined in the table below, year-over-year increases in draft beer prices decreased in each quarter of 2023:

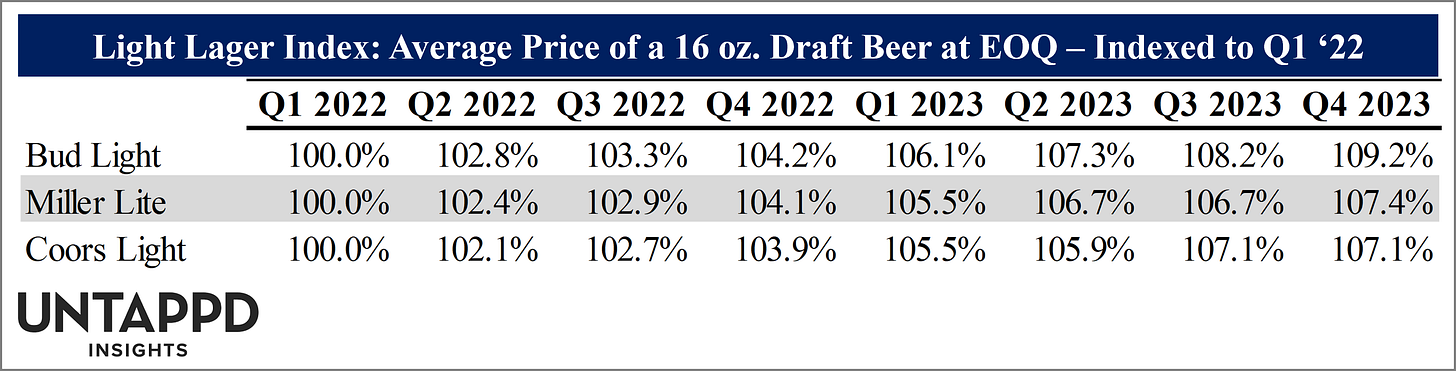

Year-over-year price increases slowed from Q1 to Q4 of last year across each of our five tracked categories, with the most pronounced drops in Independent Craft, which saw YoY increases taper to 1.8% in Q4 down from 3.9% to begin 2023, and Big 3 Macro Light Lager, which ended the year with a 3.7% Q4 ‘23 YoY increase after starting Q1 with a 5.7% increase. Our Big 3 Macro Light Lager category, comprised of Bud Light, Miller Lite, and Coors Light, experienced above average price increases in each quarter of 2023.

As for the rest of our quarterly release tracking draft price increases by category, here are the results:

Draft Beer Pricing Trends by Category

Big 3 Macro Light Lager Pricing Trends

–

From analyzing rebrands, to developing market-specific on-premise lead lists, to performing competitive analyses, our Untappd Insights team enjoyed working with many of you in 2023. If we can be of help in 2024, please don’t hesitate to reach out! You can visit our Untappd Insights page if you’d like to learn more about how our data can support your business.

Cheers,

Methodology:

The index comprises the top 25 most checked-in beers on Untappd in 2022 in the United States (with seasonal favorites like Sam Adams OctoberFest removed due to the seasonality of the product causing it to disappear from retail tap handles outside of the fall/winter).

We log pricing data from our nearly 20,000 Untappd for Business customers weekly. The end-of-quarter numbers represent the final weekly reading of each quarter.

We exclude data from our large chain Untappd for Business partners. For chains with a heavy concentration of venues in certain states, the addition/removal of a beer to their dozens/hundreds of menus can artificially inflate/deflate the average. The source data is from independent and small chain (<25 locations) retailers.

While retail menu counts powering the average of each beer vary by product (the 16 oz. draft prices of regionally/nationally-distributed craft and macro products are generally found on thousands of menus), all of these products show up on at least 70+ on-prem retail menus (i.e., some of the Independent Craft options like Russian River’s Pliny the Elder do not receive broad distribution).

Here are the beers (in order of 2022 check-ins), along with which categories we’ve grouped them into:

Guinness Draught - Macro Staple, Import

Miller Lite - Macro Staple, Big 3 Macro Light Lager

Yuengling Traditional Lager - Independent Craft

Bud Light - Macro Staple, Big 3 Macro Light Lager

Bell’s Two Hearted IPA - Independent Craft

Coors Light - Macro Staple, Big 3 Macro Light Lager

New Belgium Voodoo Ranger Juice Force - Independent Craft

Modelo Especial - Macro Staple, Import

Lagunitas Hazy Little Thing - Macro-Owned Craft

Golden Road Mango Cart - Macro-Owned Craft

3 Floyds Zombie Dust - Independent Craft

Kona Big Wave - Macro-Owned Craft

Pabst Blue Ribbon - Macro Staple

New Belgium Voodoo Ranger Juicy Haze IPA - Independent Craft

Michelob ULTRA - Macro Staple

Elysian Space Dust IPA - Macro-Owned Craft

Russian River Pliny the Elder - Independent Craft

Lunch (Maine Beer) - Independent Craft

Goose Island Hazy Beer Hug - Macro-Owned Craft

Cigar City Jai Alai - Independent Craft

Lagunitas IPA - Macro-Owned Craft

Stella Artois - Macro Staple, Import

Heineken - Macro Staple, Import

Goose Island Neon Beer Hug - Macro-Owned Craft