Introducing the Untappd Insights Draft Beer Pricing Index

Draft data analyzed from nearly 20,000 Untappd for Business independent locations reveals the impact of inflation on draft beer pricing

Before we dive into the draft pricing data, a quick housekeeping note! I’ll represent our Untappd Insights team at the Craft Brewers Conference in Nashville next week, presenting on Consumer, Beer, Brewery, and On-Premise Pricing Trends. The presentation is on Monday, May 8th at 3:45 CT in Room 202A – I’ll be unveiling the actual brand-level pricing data I’m writing about at an aggregated level in this newsletter as well as other consumer and beer insights, so please join if you’d like to learn more.

And, speaking of CBC, if you want to learn about any of the following, please come visit our Next Glass team at Booth 1431:

Untappd Insights - consumer, brewery, beer, and pricing trends

Ollie - our leading brewery management platform, helping brewers manage production, raw materials, CRM, order processing, inventory, payments, and reporting. It was Built by Brewers, for Brewers™, and is affordable, reliable, and intuitive!

Untappd for Business - our flagship drinks menu publishing software used by nearly 20,000 retailers in 75 countries!

On the subject of Untappd for Business menus, pricing data from those menus powers our Pricing Intelligence dashboard tool we used to assemble the Untappd Insights Draft Beer Pricing Index, which we’ll report on quarterly in this newsletter. You can read about the methodology and see which beers are included in the index in the footnotes below.

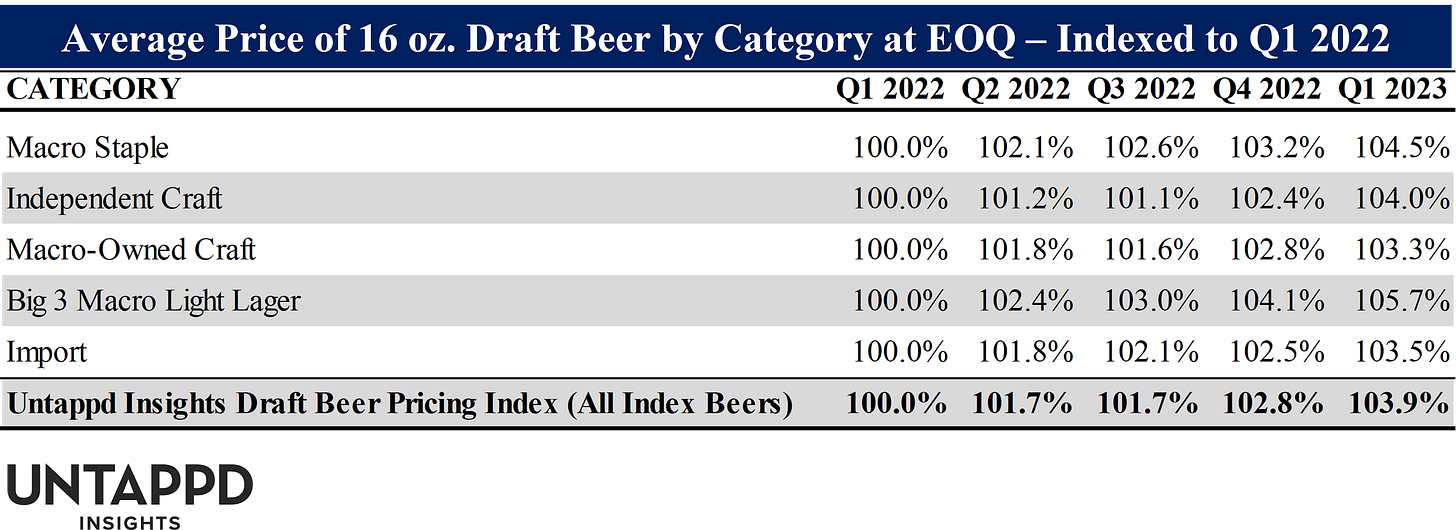

Here’s the first release covering Q1 2022 through Q1 2023:

A few observations:

The Big 3 Macro Light Lager (Bud Light, Miller Lite, Coors Light) category experienced the highest price increase on a percentage basis YoY (Q1 ‘23 vs. Q1 ‘22), increasing 5.7% over the course of the year (vs. an overall average increase of 3.9% for the entire Untappd Insights Draft Beer Pricing Index). I’ll reveal the underlying pricing data for each brand and category at CBC.

Retail outlets have increased the price of Independent Craft more than Macro-Owned Craft over the past year (index of 104.0% for Q1 ‘23 relative to Q1 ‘22) of price over Macro-Owned Craft (index of 103.3% for the same period). The Macro-Owned Craft category has experienced the smallest percentage increase of all categories over the past year.

After slowing last summer, with no increase from the end of Q2 ‘22 to the end of Q3 ‘22, the Untappd Insights Draft Beer Pricing Index has increased by 1.1% over each of the last two quarters.

–

That’s all for this month. Our Next Glass team hopes to see you at CBC!

Cheers,

Trace

Methodology:

The index comprises the top 25 most checked-in beers on Untappd in 2022 in the United States (with seasonal favorites like Sam Adams OctoberFest removed due to the seasonality of the product causing it to disappear from retail tap handles outside of the fall/winter).

We log pricing data from our nearly 20,000 Untappd for Business customers weekly. The end-of-quarter numbers represent the final weekly reading of each quarter.

We exclude data from our large chain Untappd for Business partners. For chains with a heavy concentration of venues in certain states, the addition/removal of a beer to their dozens/hundreds of menus can artificially inflate/deflate the average. The source data is from independent and small chain (<25 locations) retailers.

While retail menu counts powering the average of each beer vary by product (the 16 oz. draft prices of regionally/nationally-distributed craft and macro products are generally found on thousands of menus), all of these products show up on at least 70+ on-prem retail menus (i.e., some of the Independent Craft options like Russian River’s Pliny the Elder do not receive broad distribution).

Here are the beers (in order of 2022 check-ins), along with which categories we’ve grouped them into:

Guinness Draught - Macro Staple, Import

Miller Lite - Macro Staple, Big 3 Macro Light Lager

Yuengling Traditional Lager - Independent Craft

Bud Light - Macro Staple, Big 3 Macro Light Lager

Bell’s Two Hearted IPA - Independent Craft

Coors Light - Macro Staple, Big 3 Macro Light Lager

New Belgium Voodoo Ranger Juice Force - Independent Craft

Modelo Especial - Macro Staple, Import

Lagunitas Hazy Little Thing - Macro-Owned Craft

Golden Road Mango Cart - Macro-Owned Craft

3 Floyds Zombie Dust - Independent Craft

Kona Big Wave - Macro-Owned Craft

Pabst Blue Ribbon - Macro Staple

New Belgium Voodoo Ranger Juicy Haze IPA - Independent Craft

Michelob ULTRA - Macro Staple

Elysian Space Dust IPA - Macro-Owned Craft

Russian River Pliny the Elder - Independent Craft

Lunch (Maine Beer) - Independent Craft

Goose Island Hazy Beer Hug - Macro-Owned Craft

Cigar City Jai Alai - Independent Craft

Lagunitas IPA - Macro-Owned Craft

Stella Artois - Macro Staple, Import

Heineken - Macro Staple, Import

Goose Island Neon Beer Hug - Macro-Owned Craft