2022 On-Premise Beer Pricing Trends

Examining trends across retail categories, serving styles, macro vs. independent brands, and beer styles

Happy New Year, dear reader! It remains to be seen what topics will dominate brewing industry discussions in 2023, but the cocktail of factors – inflation, supply chain constraints, and the onset of macroeconomic weakness – impacting beer prices was certainly top of mind for industry constituents in 2022. In last month’s newsletter, we examined the average price of a pint of Bud Light and of the American IPA substyle in all 50 U.S. states.

This month, we analyzed menu pricing data published by nearly 20,000 Untappd for Business retailers to examine how prices changed between March 2022 (when we began tracking this data) and December 2022 across retail categories, serving styles, macro vs. independent brands, and beer styles.

A year ago, aluminum can shortages as well as the price of cans were a source of concern for breweries. As can be seen in the table below, beer prices in 12oz cans stabilized in the last 10 months of 2022. Aluminum futures are trading at ~$2,400/ton today, down from an all-time high of ~$4,100/ton in March following Russia’s invasion of Ukraine. The no-to-slight increase in the cost of a 12oz can of an average American Light Lager and American IPA reflect the reduction in the cost of aluminum, especially when compared to the increases in cost of draft and bottled beer.

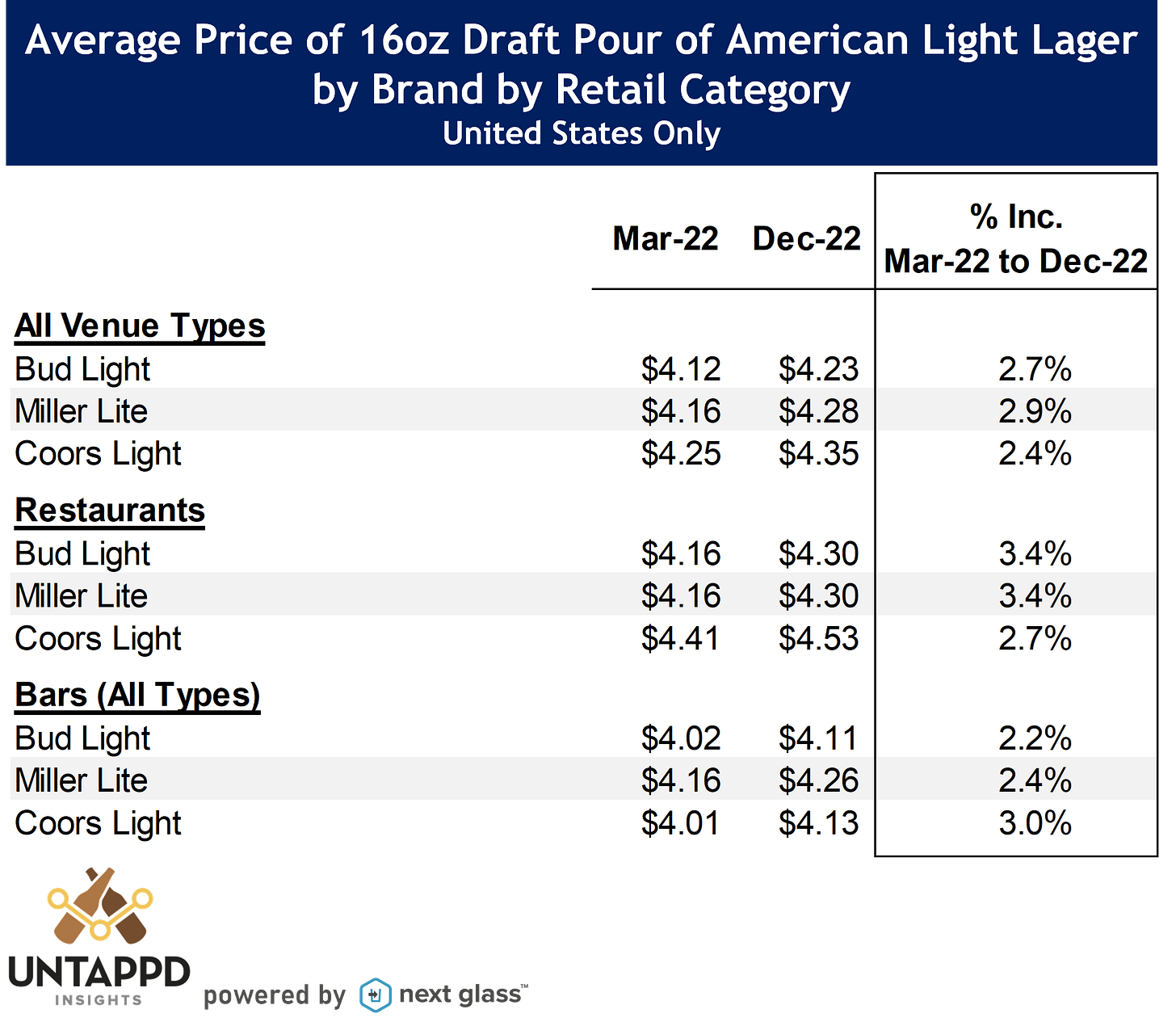

How about the cost of beer in various retail venue types? While restaurants still command higher price points across all serving styles than traditional bars, beer prices at bars (both traditional + our more specific Untappd Insights Beer Bar / Beer Garden retail category) increased more between March and December than they did at restaurants.

Brewery taprooms have seen solid price increases across three styles we examined and, promisingly, taprooms were able to command the highest increase of any category for the most popular craft substyle, American IPA. Across all venue types, however, the lower priced American Light Lager saw the largest price increase on a percentage basis.

Driving the price increase for the average American Light Lager substyle were the three most popular American Light Lagers among the Untappd app user and Untappd for Business communities – Bud Light, Miller Lite, and Coors Light. Here again, the average price of a pint is higher in restaurants than in bars but, in this case, average prices increased more across restaurants than in bars. The price of the average restaurant pint for all three beers also increased more than across all Untappd for Business retail categories (restaurants, bars, entertainment venues, brewery taphouses, hotels, etc.). I suspect increased labor costs, which are generally higher in restaurants relative to other retail categories, factored into the above average price increases of these popular products – something has to pay the bills!

And, on the subject of macro producers and price increases, it appears that leading AB InBev-owned craft brands were generally more effective at taking price in their home states relative to beers of the same style in those states. The average price increase of a pint of Elysian’s Space Dust IPA (Washington), Golden Road’s Mango Cart (California), Goose Island’s Goose IPA (Illinois), and Breckenridge’s Vanilla Porter (Colorado) significantly outpaced beers of the same style from independent breweries. Only Wicked Weed’s Pernicious increased less relative to other American IPAs in its home state (North Carolina).

I’ve spoken with a number of independent brewers that were unsure about taking price increases in 2022 (some macro producers took two price increases). It appears, based on the pricing data we see from beers coming out of AB InBev’s craft unit, that there is ample headroom for smaller producers to take more price in 2023.

That is it for this month! We’ll continue to track and report on pricing trends in 2023.

If you’re interested in what Untappd Insights can do for your business, head over to the Untappd Insights homepage to learn more about our solutions!

Cheers,

Trace

Great insight on this, Trace. Interesting to see, and I wonder if we'll see more smaller independents taking the risks and adapting these increases to better absorb some of their COGs increases.