On-Premise Pricing Trends - Craft Brewers Conference Series (4/5)

In the fourth of five follow-up newsletter updates covering my Untappd Insights presentation earlier this month at the Craft Brewers Conference (“CBC”) in Nashville, we’re examining on-premise draft beer pricing trends.

Before we jump in, I want to highlight that we provided complimentary Brewery Consumer Reports to brewers who demoed our Ollie brewery management software platform at CBC (as well as to current Ollie customers). We’re extending that offer to this readership – schedule a demo of Ollie here and we’ll provide you with a free Brewery Consumer Report on your brewery.

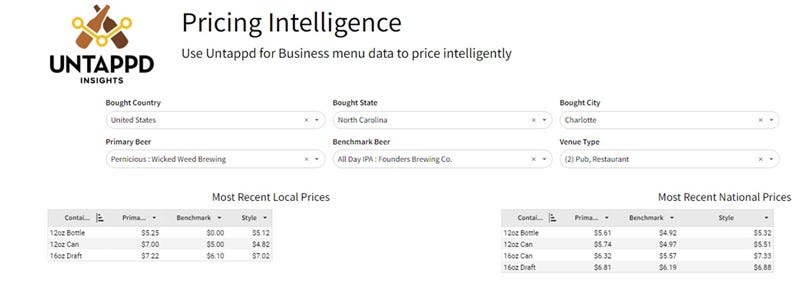

In last month’s newsletter, we introduced our Untappd Insights Draft Beer Pricing Index, which tracks the price of pints across various categories (independent craft, macro light lager, etc.). To do this, we used our recently-launched Pricing Intelligence dashboard (learn more about it at our Untappd Insights homepage), which aggregates and analyzes menu item data from nearly 20,000 Untappd for Business customers to provide on-premise pricing insights.

Untappd Insights Pricing Intelligence Tool

Leveraging our Pricing Intelligence dashboard, we tracked the average price of 16 oz. pours of beers in the index by quarter over the past twelve months.

Initial Untappd Insights Draft Beer Pricing Index

I teased in last month’s update that I’d be unveiling the underlying data from beers included in the index at CBC. Here are the underlying results showing average price for a 16 oz. pour (as well as the average prices by quarter indexed to Q2 2022) in the U.S. for each of the 25 beers in the index:

A couple of observations on the underlying brand pricing data powering the Untappd Insights Draft Beer Pricing Index:

Macro producers have been effective at increasing price over the past 12 months, with the average prices of Bud Light, Miller Lite, Coors Light, and Mich Ultra all rising by 5.5% or more over the last twelve months.

Cigar City’s Jai Alai is the only beer in the index that is less expensive on draft today than a year ago.

It appears as if the success of New Belgium’s Voodoo Ranger Juice Force in 2022 enabled the brewery to take price entering 2023.

That’s all for this post – we’ll be back to look at trends in non-alc beer consumption and retail outlet adoption with our final post in this five-part CBC series.

Until then, check-in your beers!